ComCom: Magticom’s EBITDA Margin in 2022 was Twice Above the EU Average

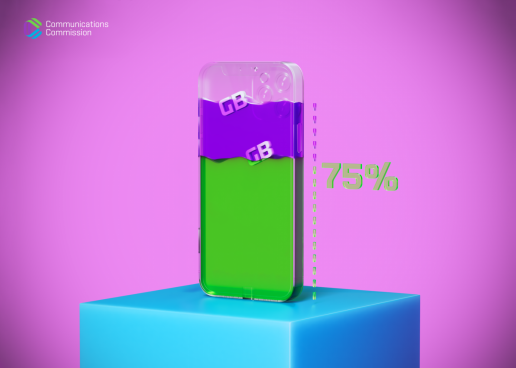

The comprehensive study of the mobile services market found that the market is uncompetitive to the detriment of the consumers. One of the factors pointing towards this circumstance is the alarmingly high EBITDA margin (earnings before interest and tax, depreciation and amortisation) posted by the Georgian operators in 2022, which significantly exceeds the EU average of 35%. Magticom’s EBITDA margin was 75% in 2022, underscoring the operator’s significant market power. Silknet (61%) and Cellfie Mobile (45%) also posted figures above the EU average.

It is worth noting that Magticom invested the same percentage of its revenues in the development of infrastructure as its European counterparts. This means that against the background of its higher EBITDA margin, the company is investing a much smaller share of its revenues in infrastructure than the European operators.

There is also a big gap between the profit margins of Magticom and other Georgian operators, which creates a potentially damaging and uncompetitive environment in which the operator with significant market power can operate independently from competitors and consumers. As an example of this, in 2021 Magticom significantly increased the voice tariffs at a time when their competitors were offering the same services at far lower rates. As a result, Magticom’s revenues from voice services increased by 10.1% during the next year while the user numbers and traffic volume remained unchanged.

As part of the proceedings on the comprehensive study, the Communications Commission will review the results at the public meeting on 6 June. Stakeholders will have until 17 May to submit their feedback regarding the results of the comprehensive study.

In 2022, ComCom launched a comprehensive telecom market study as part of the EU-funded Association Agreement Facility project. The study involved EU experts and was designed to enhance competition on the Georgian telecom market, provide consumers with diverse and affordable high-quality services, and bring the Georgian regulatory framework closer to the EU framework in accordance with the country’s obligations under the Association Agreement. The comprehensive study was carried out over a period of two years, and was unprecedented for the Georgian telecom market in its scale. The study was revised by experts from the EU Technical Assistance and Information Exchange (TAIEX) instrument.