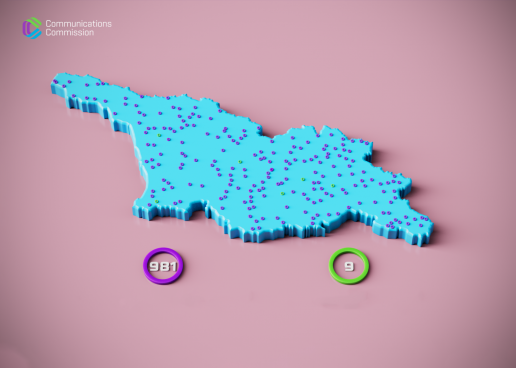

EU Experts: 981 out of 994 Settlements Connected to Fixed Internet Network are Uncompetitive, and the Market Requires Ex-Ante Regulation

“Out of the 994 settlements connected to the fixed fibre-optic internet network, 767 only have access to the services of one operator, 182 have access to the services of two operators, and only 45 have access to the services of three or more operators.” These were the findings of EU experts involved in the comprehensive study of the fixed broadband market, which was commissioned by ComCom. The study clearly shows that there is a lack of competition on the market, and this is unlikely to change without the regulator’s intervention and ex-ante regulation. The experts also found that Magticom is an operator with significant market power on the fixed broadband market. In order to overcome the existing challenges on this market, the experts outlined specific obligations for Magticom.

Today the Communications Commissioned published the results of the comprehensive study of the fixed broadband market and draft decisions for public review. In the event that members of the Commission share the experts’ opinion, Magticom will be declared an operator with significant market power, and the appropriate obligations will be imposed.

In accordance with the European Commission's market analysis guidelines, the research initially focussed on the fixed fibre-optic broadband retail market, where competition-related problems were identified. More specifically, a critically uncompetitive environment was found in 981 out of the 994 settlements connected to the fixed Internet network in Georgia, while a competitive environment was only found in 9 settlements. According to the EU experts, this circumstance clearly demonstrates the uncompetitive environment in the Georgian fixed internet market, which creates restrictive conditions for Georgian consumers.

Thus, it became necessary to study the relevant wholesale markets and conduct the three criteria test defined by the EU legislation, which determines whether the market is subject to ex-ante regulation or not. The test revealed that the market is not prone to effective competition and there are high entry barriers in this market. Specifically, large operators have infrastructure that is difficult to duplicate. A company wishing to enter the market therefore needs to conduct a significantly larger investment in order to compete with existing players. Furthermore, large operators make economies of scale at the expense of their network size and capacity, thereby reducing their own costs and creating a barrier for operators wishing to enter the market. In addition, operators who offer more than one service to customers (for example, internet and TV together) are pursuing the economies of variety, thereby lowering the average unit costs for themselves. New players are unable to do the same, which creates unequal conditions on the market. Moreover, local financial lending markets in Georgia have a higher commercial lending rate than in Europe, which is a significant barrier for new players. Thus, based on the three criteria test, EU experts found that ex-ante regulation is needed to improve the restrictive environment on the market.

As part of the public administrative proceedings on the comprehensive study, the Commission will discuss the market analysis results during the public session on 18 July. Stakeholders will have until 15 July to submit their feedback regarding the results of the comprehensive study. Furthermore, the Commission ensured the involvement of Georgian operators at each stage of the research throughout the past two years.

In 2022, the Communications Commission, together with the experts of the European Union, with the funding of the European Union and within the framework of the assistance for the implementation of the Association Agreement between the European Union and Georgia (“AA Facility II”), started working on the comprehensive research project on the Georgian telecom market. The project serves to enhance competition on the Georgian telecommunications market, bring the regulatory framework of Georgia closer to the European framework in accordance with the obligations under the Association Agreement, as well as provide diverse, high-quality and affordable services for consumers. The comprehensive study was conducted over two years. Research of this magnitude has not been conducted on the Georgian telecom market before. The study conducted by the EU experts was also revised by the experts of TAIEX (EU Technical Assistance and Information Exchange Tool).